How to send money to Russia

If you sometime try to buy anything from Russia, especially on their inner auctions and online flea markets, you probably know that there are two main problems:

- Conversation with russian seller to get his agree to send the goodies abroad

- How to pay to seller from Russia

Best way to transfer money to Russia

TransferWise, a global money transfer solution.

I’ve had some excellent results with TransferWise over the past twelve months, as I send money back to Russia from USA. Here are a few things which I think make it stand out as a market leading service:

- A market leading service

- Best rate guaranteed

- Low fees

- Supported currencies

- Perfect for all amounts

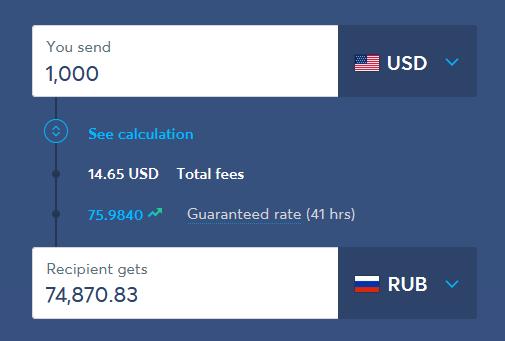

TransferWise promises its customers transfers at the mid-market exchange rate, which is just about as good as it goes. To ensure that you’ll be happy, they even have a “cheapest money guarantee”. What this means to the everyday customer is that if you receive a quote from another provider, offering a better deal than the mid-market rate, they’ll match it or refund the difference.

Instead of hidden fees of up to 5% charged by traditional services, TransferWise charges a small transparent fee, amounting to 0.5% of the transferred amount – the equivalent of paying 50 cents for every $100 transferred. That’s it! No variable fees, no exchange rate spreads. Just an honest and transparent service.

TransferWise is growing into a truly global company, already supporting over 27 currencies around the world, including the market’s largest pairings such as US Dollars, British Pounds, Euros, Indian Rupees, Swiss Franc, Hong Kong Dollars, Japanese Yen and Australian Dollars, just to name a few.

TransferWise can handle a wide variety of payment values, anywhere from a few dollars up to the USD equivalent of £1,000,000. Their flat fee of 0.5% means that TransferWise is a perfectly sufficient way of sending even the smallest amounts of money internationally. Perfect for paying bills across borders, or transferring funds to friends and family.

As with most things in life, it’s not all sunshine and roses. Here are a few things that you should know about TransferWise’s service before getting started:

- Transfers take a couple of days

- Some internet skills are needed

- No physical branches, but great customer service

As with most electronic foreign exchange services, the transfer process is not immediate. TransferWise advises its customers that most exchanges take anywhere from 1-4 days, depending on the currencies involved. In my experience, the transfer of funds usually takes about 2-3 days, from start to finish.

It should be said that if you’d like to use TransferWise, you’ll need to know how to use the internet. TransferWise’s platform is available on the internet and through mobile apps, and at least in this regard, the positive thing is that their system is easy to use. Most users of a modest ability will be up and away in 5-10 minutes.

TransferWise is 100% internet based. Therefore, unlike the bank or Western Union type services, there are no physical branches. Despite this, TransferWise has some excellent customer support available over email, and they also list the contact phone numbers for their offices in the United Kindom, United States, Germany, and Estonia.

Is TransferWise safe to use?

Is TransferWise safe? A very important question. You’ll be happy to hear the answer is yes. TransferWise has been operating successfully for over five years now, and has amassed a large and loyal customer base. Having a large customer base means they handle a lot of money, to ensure they can fulfill their orders.

Holding a lot of their customer’s money, means that it’s in TransferWise’s best interest to keep everyone’s money safe. Security is essential to their reputation and ongoing business success, so they certainly don’t to mess around. To ensure that they maintain a safe and efficient service, TransferWise maintains competency in a few key areas:

- Regulatory oversight

- Customer funds held in trust

- Website security

- Managing exchange rate risk

TransferWise is registered with the UK Financial Conduct Authority (FCA). The FCA is a regulatory body who aims to make sure that financial markets are run with integrity so customers get a fair deal. This body is funded by the firms they approve, however they do report to UK treasury and parliament as an independent body. TransferWise and their partner companies are also registered in each jurisdiction of their company’s operations.

To maintain financial integrity TransferWise keep their customer’s money separate from their own operating accounts. By doing this, the funds used to run their business are independent of monies received by customers for trading between currencies, which are kept in special trust accounts.

Being 100% international based means that website security is a priority, especially when dealing with potentially large transactions. With TransferWise, there’s no need to worry, as all your personal information is protected using HTTPS security encryption – keeping your details safe from prying eyes.

When you complete your transfer, TransferWise does everything it can to provide you with an accurate quote of the exchange rate. Because exchange rates are known to change at short notice, their system allows you to select your “tolerance” for currency movements. If the mid-market rate suddenly moves outside your tolerance level, the trade will be canceled, providing you with total flexibility and piece of mind.

Ready to get started? A step-by-step guide

If you’re ready to send money abroad and you think that TransferWise is right for you, that’s great to hear, you won’t be disappointed! TransferWise has developed their service in a simple and easy manner, allowing just about anyone to use their interface. Below, I’ll show you how to get started in 4 simple steps:

1. Getting started

Go to transferwise.com. When you first arrive on the website, you’ll be greeted with simple currency calculator. For a quote, enter your intended transfer amount and destination currency. You can send funds to your own account overseas, another person or business. TransferWise’s low fees are carefully outlined.

2. Upload money

Send TransferWise your funds in local currency. You can make a normal bank transfer or use a debit card like you’re shopping online. Specify a value and a destination, then select your preferred payment method. Enter your details or upload your money and you’re done. This takes just a couple of minutes and is your part done.

3. Conversion

TransferWise converts your money at the mid-market exchange rate and matches your request with people transferring funds in the other direction (that’s why it costs so little).

4. Money sent!

The converted funds are sent to your destination bank account. All parties to the transaction (you and your recipient) are notified by email along the way, so you always know where your money is. Within a few days, your cash is delivered to the recipient in the requested currency. It’s as simple as that!

TransferWise in the app store

TransferWise understands that not everyone has time to jump onto the computer everytime they need to transfer money. As as result, TransferWise has developed a mobile app for iPhone, iPad, and Android.

The app is with a simple and functional interface and is perfect for making payments on the run. It will work wherever you have access to the internet, either through Wifi or 3G. It supports payments by bank transfer and debit card and displays every detail you need to keep track of its process. During any payment, you can also monitor its status and if needed, cancel it.

In addition to its standard functions, TransferWise have included the following features:

- Invite friends to TransferWise by SMS, email, Facebook & Twitter

- Send-in and verify identification documents

- Set up fixed target amount payments to your recipient

- Set up transfers with new and previously used recipients

Final thoughts

I hope this review has provided you with an insight into the TransferWise operation and its many benefits. If you’d like more opinions on the quality of service, be sure to check out the reviews of 16,000 happy customers over at Trustpilot.co.uk. As for me, I’ll continue to use TransferWise on a monthly basis, as it makes my life a lot easier knowing that I’m getting an honest and competitive deal.

Five stars.

Sending money to Russia – to bank “Sberbank”

The most spread paymnet method between buyers and sellers inside the Russia it’s direct transfers to credit or debit card. Ususally it’s cards of Sberbank – the most huge russian bank.

And when you succesfully conversated with seller about international shipping from Russia the next thing which can destroy the bargin – it’s fast and suitable for all payment method. The Russian have not money orders. Also not each seller have good relations with PayPal.

Western Union and transfers to bank account are good enough except the need to go somewhere for you and oftenly the seller don’t want to go the bank office too.

Today you will know how the way to pay to russian card directly sitting on your chair.

All you need – your card and PC,laptop or smartphone.

Let’s me introduce such payment system like PAYEER, which allow transfer money to any card (Visa, Mastercard, Maestro) of any russian bank (Sberbank and others).

.jpg)

Step 1:

open the account at the Payeer.com (yes, this system support english language)

Additional video how to do it here:

https://www.youtube.com/watch?v=iLdEsPeuRrA

Step 2:

fund your payeer account with your card (or via other online currency, even Bitcoin supported)

Step 3:

transfer money from your payeer balance to any russian bank’s card

.jpg)

Here also explanatory video instruction:

That’s all, done!